Compare Standard and Premium Digital here.Īny changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many user’s needs. If you’d like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial.

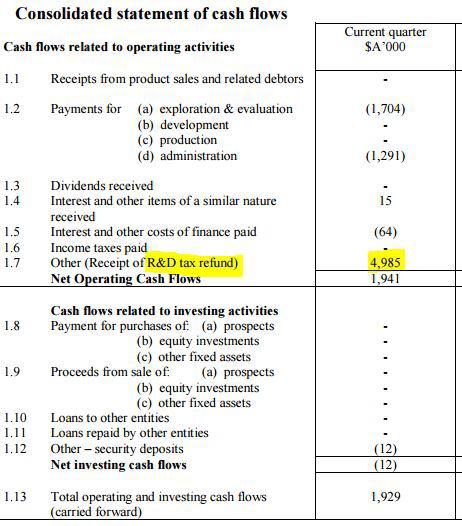

If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for $69 per month.įor cost savings, you can change your plan at any time online in the “Settings & Account” section. First, note that this is really a A1.5 million deal, not a A4 million deal as the headline says. For a full comparison of Standard and Premium Digital, click here.Ĭhange the plan you will roll onto at any time during your trial by visiting the “Settings & Account” section. Here are the terms of the financing with Lind Capital. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Standard Digital includes access to a wealth of global news, analysis and expert opinion. On Twitter, Facebook, Google News, and Instagram.During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. “It's a long road ahead.”įollow HT Tech for the latest tech news and reviews, also keep up with us “It will get worse before it will get better - way too much UST is looking to exit, and the death spiral is very reflexive at these levels,” added Fadeev. Hallmarks of shadow banking, such as circular market mechanics and extremely high leverage, are readily visible among Terra's ecosystem, something that academics fear could create a second, digital wave of failed lenders and wiped-out savings. While its total amount deposited sat as high as $14 billion on Monday, it had around $3.6 billion in UST still on its books by mid-afternoon in London on Wednesday.Īlready, comparisons with the 2008 financial crisis have started to roll in.

Death spiral financing driver#

Meanwhile, crypto firm Celsius said it “was not and is not involved” in any Luna bailout.Īnchor, now a shadow of its former self as the main driver of demand for UST on the Terra network, has proposed temporarily cutting its interest rate to a minimum of 3.5%.

Terraform Labs, which powers the Terra blockchain, is backed by firms including Galaxy Digital, Pantera Capital and other players in crypto.Īmong the firms that were approached via a round robin in the latest financing attempt were Nexo and crypto banking app Cashaa, which declined to participate. “This morning, there is virtually nothing left.” In order for UST to re-peg, she said, buy orders from crypto traders will need to consume all of the asking price's liquidity to get it up to $1. “Once liquidity evaporated, this perpetuated the collapse of the stablecoin,” said Clara Medalie, research director at Kaiko, in an email. Some suspect that $1.5 billion won't even be enough, and it could take days, if not weeks, for UST to re-peg to the dollar. He's now attempting to raise $1.5 billion from new and old investors alike to provide more collateral to UST, hoping to rebuild the token's liquidity after it virtually disappeared from order books overnight. But one thing's for certain: Kwon isn't going down without a fight. It is full capitulation.”Įxactly why all of Terra's carefully-planned mechanisms failed to do their job remains unclear, and conspiracy theories abound about shadowy actors with untold wealth to play with. “Many people were caught off guard,” said Nikita Fadeev, partner and head of crypto fund Fasanara Digital, which de-risked its position in advance of the crash. Luna also fell considerably, dropping to as low as $2.35. But on Monday, all of the mechanisms that were supposed to keep UST stable, weren't - it fell to a low of 60 cents on that day, and reached a further low of around 20 cents in another crash on Wednesday, taking its market value down from $18.4 billion to $5 billion. A month ago, the future looked bright for Terra and its main backer Do Kwon: a consortium called the Luna Foundation Guard aimed at providing collateral for Luna - then at an all-time high value of $119 - had bought more than $1.5 billion in Bitcoin to shore up UST's peg, with its members reading like a Who's Who of crypto.

0 kommentar(er)

0 kommentar(er)